refinance home equity loan texas

3 Ways to Refinance Your Home Equity Loan. Refinancing an existing loan may result in the total finance charges being higher over the life of the loan.

How Long Does It Typically Take To Get A Home Equity Loan

The lowest APRs are available to borrowers requesting at least 80000 for second liens or 200001 for first liens with the best credit and other factors.

. Eligibility is subject to completion of an application and verification of home ownership occupancy title income employment credit home value collateral and underwriting requirements. You may not realize a savings over the entire term of your new Loan In addition your Loan may require you to incur premiums for hazard and if applicable flood insurance which would affect your. In this example you have 80000 worth of equity in your home that you can tap into.

Beware of the catch though. Use our home value estimator to estimate the current value of your home. Learn how you can refinance your mortgage.

Citation neededHome equity loans are often used to finance major expenses such as home repairs medical bills or college. The number of days from application to approval will vary for purchase and refinance home loans. The timeline is generally 30-90 days.

Closing costs can include things such as home inspection loan origination fees property taxes. Learn more about using a home equity loan for a second home. VA Cash-out Refinance Loan See note 1.

Now is a the time to refinance your existing mortgage and lock in a low fixed rate. Although some lenders may reduce or waive them altogether home equity loan closing costs typically range anywhere from 2 to 5 of the loan amount. That includes houses condos townhomes or duplexes.

Bank of America is a big bank lender that offers mortgage and refinance loan products along with full banking services. Refinance your existing mortgage to lower your monthly payments pay off your loan sooner or access cash for a large purchase. However taking equity out of your home to buy another house comes with risks.

The other product is a home equity line of credit HELOC. Receive assistance from our customer support. Our experienced home loan advisors can help you find the right mortgage loan for your situation and guide you through the process.

Mortgage Broker California and Arizona. For a rate-and-term refinance the equity requirement will vary by lender but youll most likely need to continue paying PMI even after a. Home equity loan closing costs and fees.

There are more than 5000 branch locations in the US in addition to its. Find and compare the best rates for mortgage refinance home equity personal loans and auto loans. A mortgage refinance can help you pay off your home sooner lower your monthly payments and more.

Check our rates and lock in your rate. Our home loan refinance options could help reduce your interest rate shorten your term or trade in the equity of your home to get cash back at closing. Over the years you paid another 40000 down on your principal and you have 120000 left on your loan.

A home equity loan is a type of loan in which the borrowers use the equity of their home as collateralThe loan amount is determined by the value of the property and the value of the property is determined by an appraiser from the lending institution. You can borrow against the equity in your home and access the cash immediately through a home equity loan or cash-out refinance. Not all programs are available in all areas.

Get your mortgage loan questions answered with our mortgage and home equity FAQs. ERATE is not affiliated with eRates Mortgage or Finance of America Mortgage. Get 35000-300000 from your homes equity with a low fixed-rate home equity loan from Discover with zero origination fee.

The home must be in Texas and be single-family owner occupied. CUTX does not provide home equity loans or mortgages for mobile homes or manufactured homes. In exchange for an available cost reduction or waiver if you pay off and close the loan within a certain period usually three years you may.

Using a home equity loan also called a second mortgage to purchase another home can eliminate or reduce a homeowners out-of-pocket expenses. Lower your payments with an easy refinance loan from Texas Loan Star Inc. Home Equity is the difference between the market value of your home and what you owe on the mortgage.

Personal Home Equity Solutions Home Equity Loan HELOAN 888 248-6423. A home equity loan is a consumer loan allowing homeowners to borrow against the equity in. The APR will be between 599 and 999 for first liens and 699 and 1299 for second liens based on loan amount and a review of credit-worthiness including income and property information at the time of application.

There are many uses for a home. Note 1 USAA Bank does not offer a cash out refinance product in the state of Texas. Yes you can use a home equity loan to buy another house.

These are fixed-rate loans with terms of up to 20 years although you can get a lower rate by choosing a term of 15 years or less. 4875 See note 2. Compare FHA refinance rates.

5 Types of Private Mortgage Insurance PMI. In Texas the Wells Fargo home equity. 5328 APR See note 3.

USAA allows you to borrow against up to 80 percent of your home value on a home equity loan minus whatever you still owe on your current mortgage. See our current refinance rates and compare refinance options. And borrowers can have only one Home Equity Loan at a time.

Learn more about prequalifying applying rates and terms and more at Wells Fargo. Current interest rates are still historically low. Get a Mortgage Quote.

Refinance closing costs vary by lender and can add up from 2 to 5 percent of the loan amount. An FHA refinance loan is a refinance insured by the Federal Housing Association.

:max_bytes(150000):strip_icc()/dotdash-refinancing-vs-home-equity-loan-v2-7581ca7e240847fb972ef6efee18492e.jpg)

Cash Out Refinance Vs Home Equity Loan Key Differences

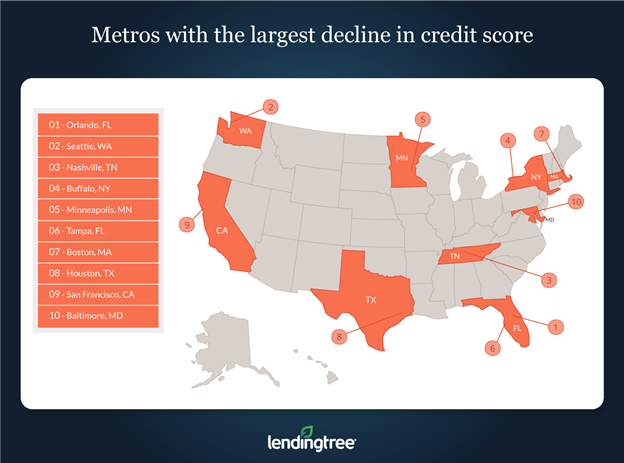

Study Home Equity Loans Have Minor Impact On Credit Scores Lendingtree

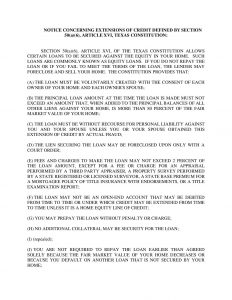

Tx Home Equity Security Document Complete Legal Document Online Us Legal Forms

Can You Use Home Equity To Invest Lendingtree

Refinance A Home American Pacific Mortgage

/dotdash-refinancing-vs-home-equity-loan-v2-7581ca7e240847fb972ef6efee18492e.jpg)

Cash Out Refinance Vs Home Equity Loan Key Differences

Cash Out Refinance Mortgage Refinance U S Bank

Texas Home Equity 12 Day Notice For Home Equity Loans Black Mann Graham L L P

How Does A Home Equity Loan Work In Texas

Texas Home Equity Cash Out Refinance A6 Mortgagemark Com

Best Heloc And Home Equity Loan Lenders In Texas Nextadvisor With Time

How Does A Home Equity Loan Work In Texas

9 Best Home Equity Loans Of 2022 Money